If health coverage can be a part of your 2026 budget, it will give you peace of mind and many benefits up-front.

We know cost is a big concern for CoverME.gov members. Unfortunately, there are more price changes than usual for 2026.

-

Reason 1: Higher premiums and deductibles.

-

Insurance companies, not CoverME.gov, set their prices each year. This year, average prices and deductibles have increased more than usual.

-

Reason 2: Expiring Enhanced Premium Tax Credits.

-

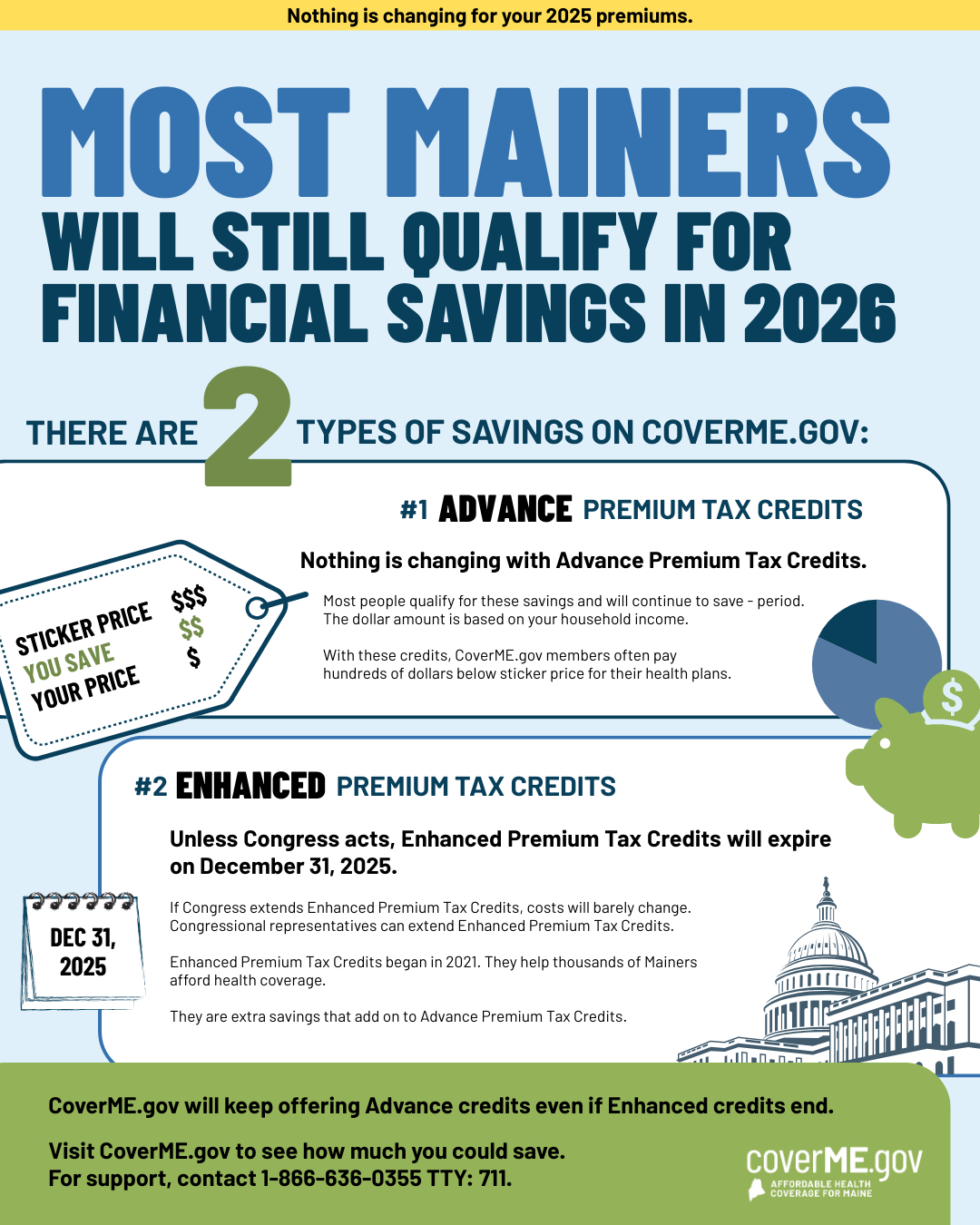

The federal government plans to end a large portion of CoverME.gov savings. Since 2021, extra savings by tax credit have been available to CoverME.gov consumers who qualify. These savings, called Enhanced Premium Tax Credits (EPTC), will end unless Congress acts. Without EPTC, your monthly premiums will likely increase in 2026.

View an accessible version of the above graphic.

Considering coverage?

Keep these important things in mind!

Your time and health are valuable to you, and to us. Enrolling in coverage can be easy and fast. Don’t miss out on financial savings or health insurance for 2026!

- Many Mainers will pay much less than expected.

-

7 out of 10 Mainers enrolled in 2026 coverage through CoverME.gov qualify for financial assistance. Right now, among those who qualify for financial assistance, the average monthly payment per person is just under $190. To estimate your monthly payments, use our Plan Comparison Tool for free today.

Remember! You must enter your estimated household income for 2026 in the Plan Comparison Tool to see accurate savings.

- Most plans have pre-deductible coverage.

-

Depending on the plan you pick, you can get a lot covered. This includes cancer screenings, wellness visits, primary care and specialist office visits, urgent care, and even prescription drugs.

Many services are free or low-cost! You get this coverage before you hit your deductible.

- Local experts are available - for free.

-

More than 9 out of 10 CoverME.gov members are happier when they work with an expert to sign up for health coverage. Find local help or check out the Consumer Assistance Center hours.

- A Bronze plan might be exactly what you’re looking for.

-

Bronze plans have lower monthly premiums than Silver, Gold, or Platinum plans. This makes them ideal for people on a tight budget who don’t expect to use a lot of healthcare. Bronze plans fit the budget for many Mainers and still offer protection from major medical emergencies.

All bronze plans available through CoverME.gov are eligible for opening a Health Savings Account (HSA). This means you may be able to contribute pre-tax dollars to a savings account. Use these dollars to pay for out-of-pocket medical expenses and lower your taxable income to qualify for greater savings.

Worried about costs?

Let's make sure you don't leave any money on the table.

This winter, we’ve spoken to Mainers thinking about skipping coverage. After taking a few simple steps, they found out that they qualified for more savings than expected and got covered! Don't leave your money - or peace of mind - on the table.

- Update your expected 2026 income.

-

Has the income you expect in 2026 changed for anyone in your household? If yes, update your account ASAP. This may put you in a different income bracket and make you eligible for financial savings. By updating your income, you will be sure to get any savings you might be eligible for. Make sure you enter the best estimate of your expected yearly income. Reporting that you make less than you do may result in significant repayments at tax time.

- Confirm your household size is accurate.

-

Have a new dependent? Did an adult child move out? Household size is a big part of calculating if you qualify for financial savings. If your household size has changed, update your CoverME.gov account to include the right people. Learn who to include here.

- Compare health plans.

-

If your costs are changing, check to see if there’s another plan that works for your household. You may find a plan that meets your health needs and fits your budget with a lower monthly premium. CoverME.gov's Plan Comparison Tool is a free, in-depth resource. See exactly what plans cover and cost. If cost is a barrier, you may even want to consider a Catastrophic Plan.

- Lowering your taxable income could lower your costs – a lot.

-

Savings on CoverME.gov are income-based.

If you have a tax preparer, talk to them about ways you might be able to qualify for savings. This could include making contributions to an Individual Retirement Account (IRA) or to a Health Savings Account (HSA).

No tax preparer? No problem. Anyone can speak to a free local expert from CoverME.gov’s list of certified Brokers and Enrollment Assisters. These experts can't give tax advice, but they can help you understand what to include as income on your application.

Questions? We have answers. Who can enroll? How do I get financial savings? Am I doing my application right? Find answers to these questions online, or give us a call.

Changes to Getting Coverage

More secure passwords.

- Starting August 11, all CoverME.gov passwords need to be longer. We're required to make this change to protect Federal Tax Information. When you log in, you'll be asked to pick a new password that is at least 14 characters long.

Text messages to make it easier to stay informed.

- Starting this year, if you selected text messaging as a preferred contact method, you'll receive a text notification when a new message is posted to your online account. To change your texting permissions, log in to your CoverME.gov account. Go to My Household, Edit Member, and check the box next to "Text" under Contact Method(s). Confirm your mobile phone number is accurate and save your changes.

Self-service password reset.

- Forgot your password? Reset it quickly and securely using your email or mobile phone.

Watch for communications from CoverME.gov about outstanding verifications.

- Because of a new federal rule, members may need to submit more documents to get coverage. We will contact you if we need documents such as paystubs and citizenship paperwork. Submit documents quickly. If you don't, you could lose financial savings or even lose coverage.

News for Taro customers

Taro, a health insurance carrier on CoverME.gov, changed their name and is now known as Mending. Learn more on our Frequently Asked Questions page.